The 5 Ws of OPEX - Quit Feeling Sorry For The Computer!

- Jeff Jacobsen

- Oct 28, 2020

- 4 min read

Having created the first commercial AFE Management System in the oilfield, BengalAFE, I am well versed in answering the 5 Ws of CAPEX spending:

Who – who is creating the AFE (AFE Coordinator), who is responsible for the work (AFE Engineer), and who is performing the work (Vendor(s))?

What – what exactly are we using the $$s for (drilling, workover, etc.)?

When – when will the work be done, the materials delivered, the tasks performed?

Where – where will the work be performed, e.g. which cost center?

Why – a detailed explanation of why the work is being done, coupled with backup detail, e.g. economics.

I understand that this tremendous level of detail is needed with such complex and costly operations. But why don’t we employ the same level of detail to control OPEX?

Without naming names, the following is an anecdote from my years trying to help oil companies control their OPEX. Let’s say you are a lease operator working on Main Pass 21 B Platform, and you are experiencing an issue that calls for well intervention, on Well #1A. After a quick call to the engineer in the office, it is determined that we need to inject chemicals in the well, just like we always do. Left to his own devices, the lease operator calls his favorite vendor, Chemicals R Us, and proceeds to place an order for the necessary chemicals. Not wanting to get chewed out, the lease operator “plays it safe” and orders triple the quantity he thinks is required. The vendor gladly obliges, delivers the chemicals, leaves behind a field ticket, and the works ensues. The chemical injection goes well, using the original amount agreed upon, and the engineer is pleased with the increase in production. Problem solved, right? Here is where the fun starts – two weeks later, the invoice for the chemicals arrives in the office, ready to be approved, coded, and paid. When the engineer reviews the invoice, he cannot understand why the vendor sent three times the amount of chemicals required. This creates the email thread from hell between the engineer, lease operator, and vendor. The final verdict is to approve the invoice, making note of the excess chemicals available on Main Pass 21 B Platform, which will be credited until needed. The invoice is then sent to be coded, and lo and behold, the invoice coder does not exactly know how to issue a credit. But not to worry, it is coded, sent to Accounts Payable, and ultimately paid. This entire process took three months from requesting the chemicals to the information being available to the operations team in charge of Main Pass 21. Imagine management’s surprise when they find out that Chemicals R Us is now in the Groceries business, and they are delivering groceries to Main Pass 21 E platform, which is about to be plugged and abandoned! Believe me when I tell you, this is not farfetched.

So how exactly can this happen? It is quite easy if you think about it in terms of the dynamics of the oilfield, especially the GOM, where there is a world of things going on constantly, and you can’t exactly use Amazon Prime. The obvious issues in the above example are:

Accountability – the lease operator bore no accountability for the order, except to get the job done. In the process, he ordered too much chemicals, probably at a price higher than needed.

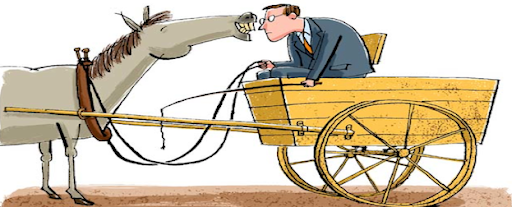

Timely reporting of costs – the three month cycle for reporting caused a) poor matching of revenues versus expenses for determining profitability, b) accrual accuracy is poor due to mismatched timing between service date and reporting date, and c) inability to manage projects in a timely fashion – it’s like driving a car using the rearview mirror.

Poor internal invoice coding controls – led to excess chemicals being coded to the wrong chart of account item and cost center.

Now, imagine a system that gives you the same level of detail and control over your OPEX as you demand for CAPEX. You can if you quit feeling sorry for the computer.

Using our BOE Cloud Portal, we have created an OPEX Cost Control System for the oilfield that seamlessly answers the 5 Ws of OPEX spending, all from any browser with an internet connection. The OPEX Cost Control System is made up of 4 components:

Concordia Asset Management – houses every asset for your company tied to the regulatory agencies, enabling a “One Version of the Truth” paradigm.

Mercado Procurement – a full featured procurement system, with vendor integration. Roles include Requisition, Approver, Buyer, and Vendor. Creatable items such as Requisitions, Quotes, and Purchase Orders.

Cost Tracker – database application to gather all costs from the field. Tightly integrated to Mercado, allowing “real-time” field costs available to decision makers.

Wrangler/Arsenal – data analytics application for the creation of reports/dashboards for timely delivery of information to the decision makers in the OPEX process.

Using the tools from the BOE Cloud Portal, it is extremelyeasy to track the 5 Ws.

Who? The systems tracks all the necessary personnel, from the person who requested the goods/services, to the person who approved the request, to the buyer who receives the quote from the vendor, to the vendor who provided the goods/services.

What? The system tracks all good/services down the Chart of Account line item, from the initial request to the entry into the AP system.

When? The system tracks all the critical dates – request date, approval date, quote date, PO date, and most importantly, activity/delivery date. Once a PO item is accepted for delivery, the associated costs for the item delivered is available to decision makers in the process. Accrual issues are virtually solved from day one in real time.

Where? All cost center information is tracked through the process, from the delivery point to the asset, ensuring profitability calculations are accurate and timely.

Why? The approval mechanisms throughout the process document all necessary information on the need for the goods/services.

Perhaps the most valuable aspect of the OPEX Cost Control System is its own cost – utilizing cloud-based technologies allows BOE to greatly reduce implementation costs, while also offering a pay-as-you-grow model with no long term commitments.

Comments